will salt deduction be eliminated

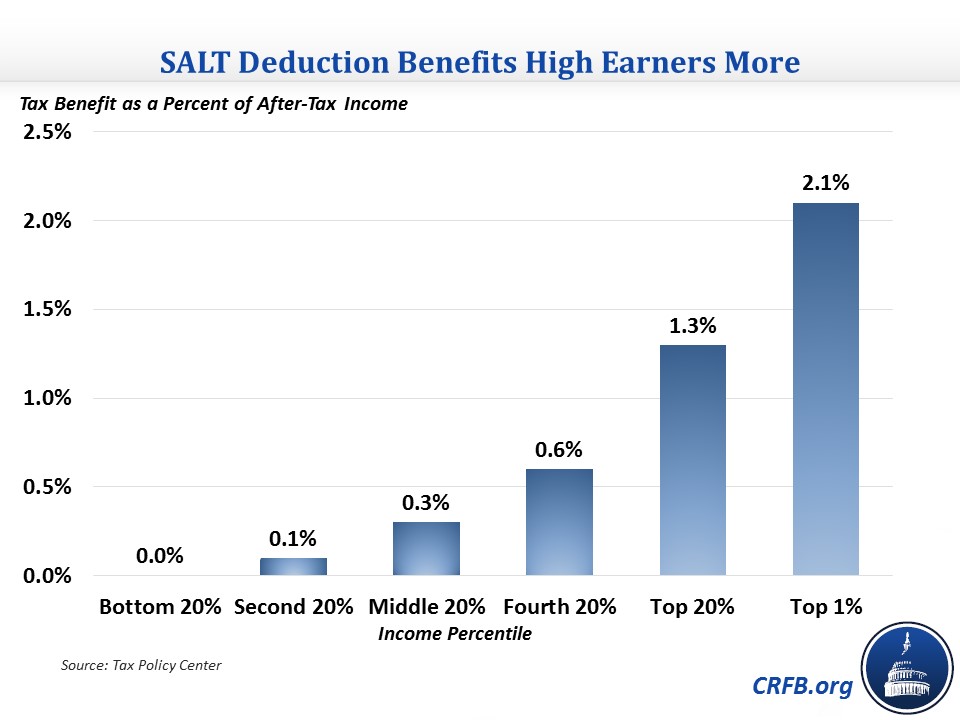

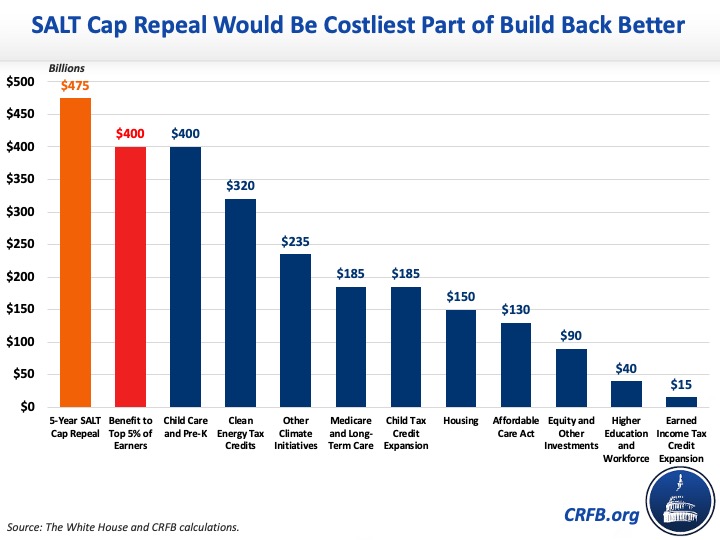

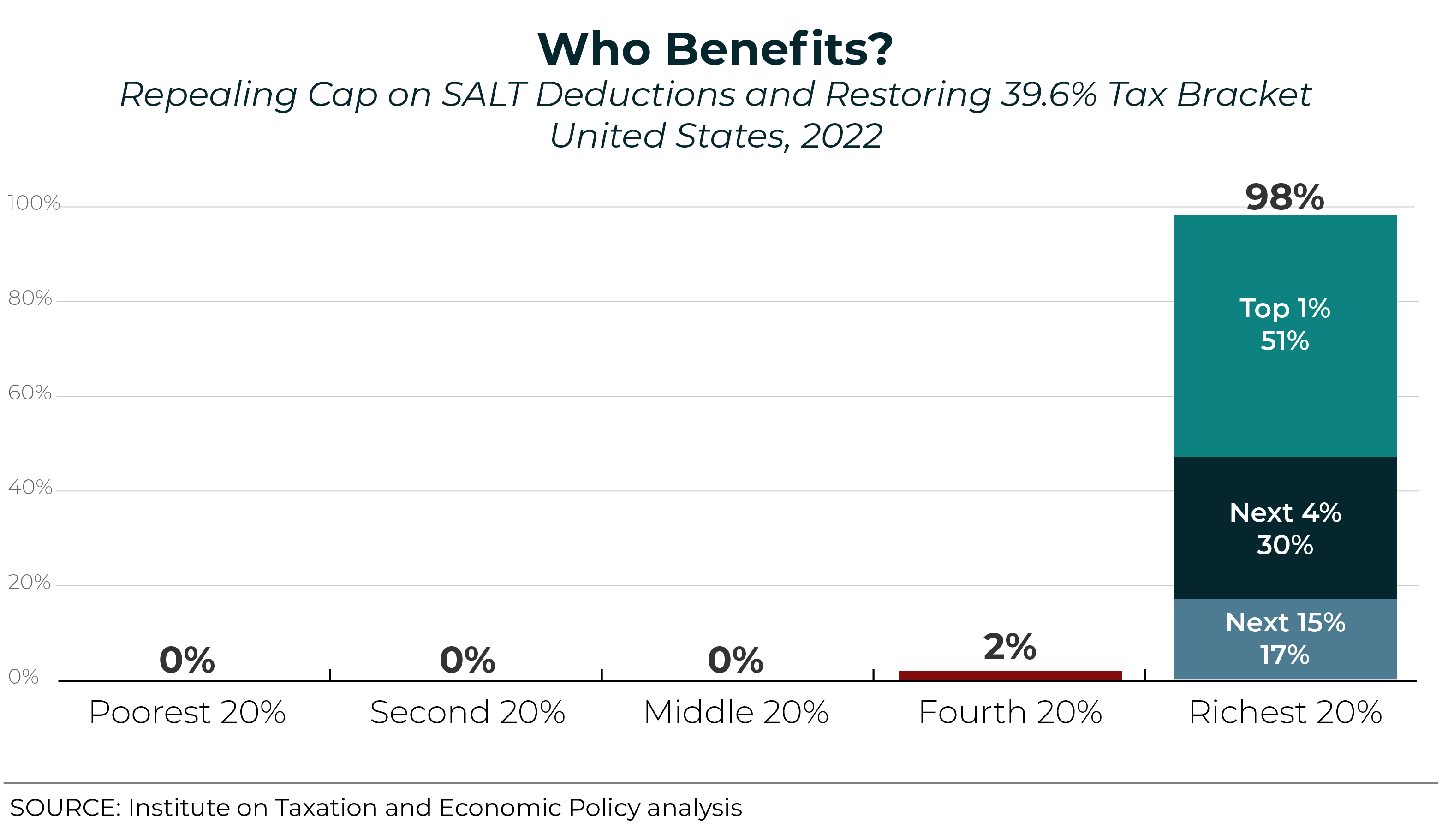

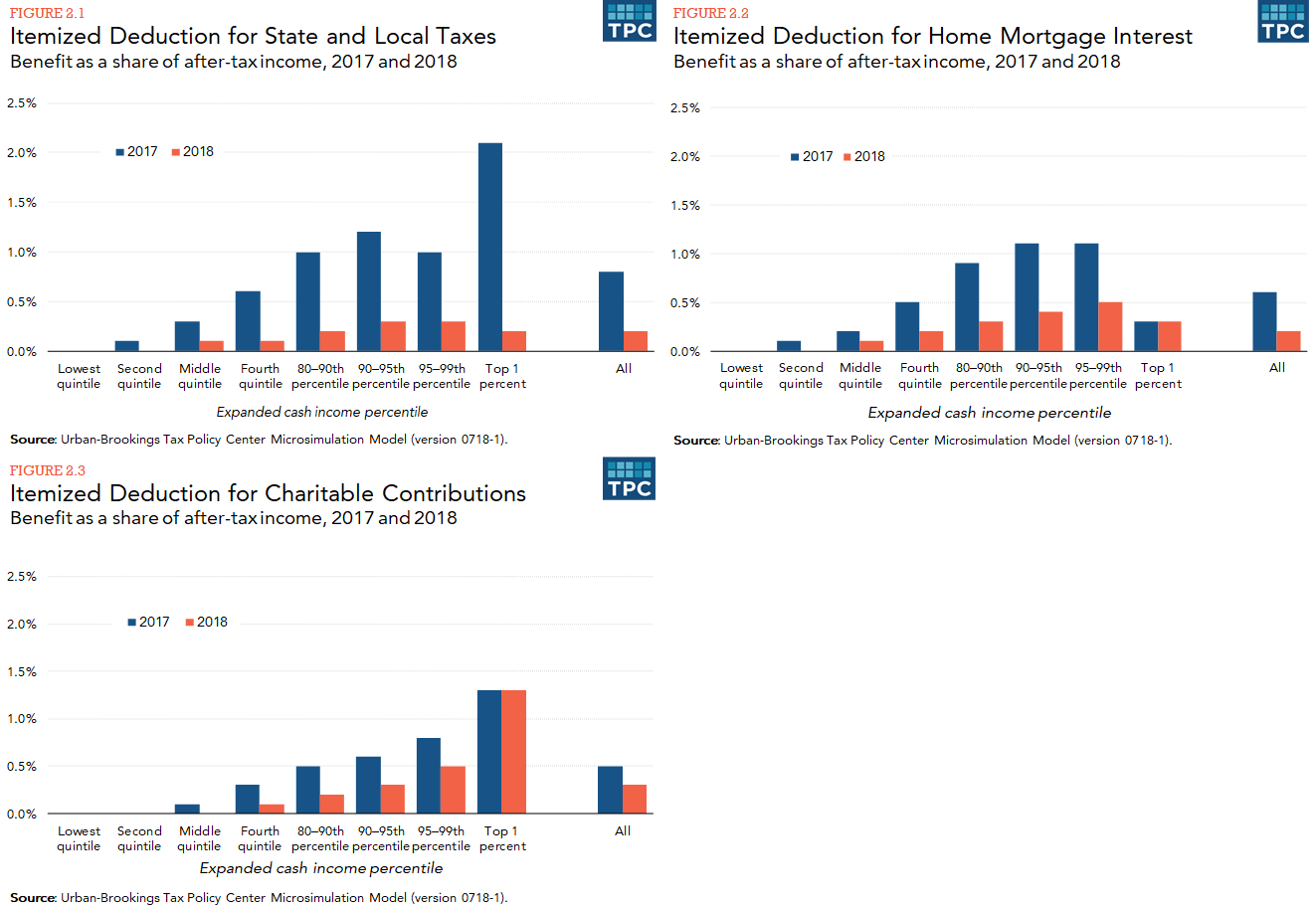

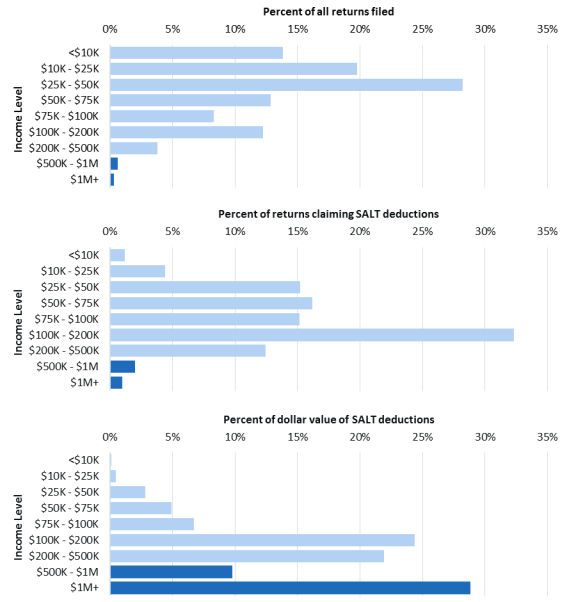

It is important to understand who benefits from the SALT deduction as it currently exists and who would benefit from the deduction if the SALT cap were repealed. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better reconciliation package including.

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Senate Majority Leader Chuck Schumer D-NY has expressed interest in repealing the SALT cap which was originally imposed as part of the Tax Cuts and Jobs Act TCJA in late 2017.

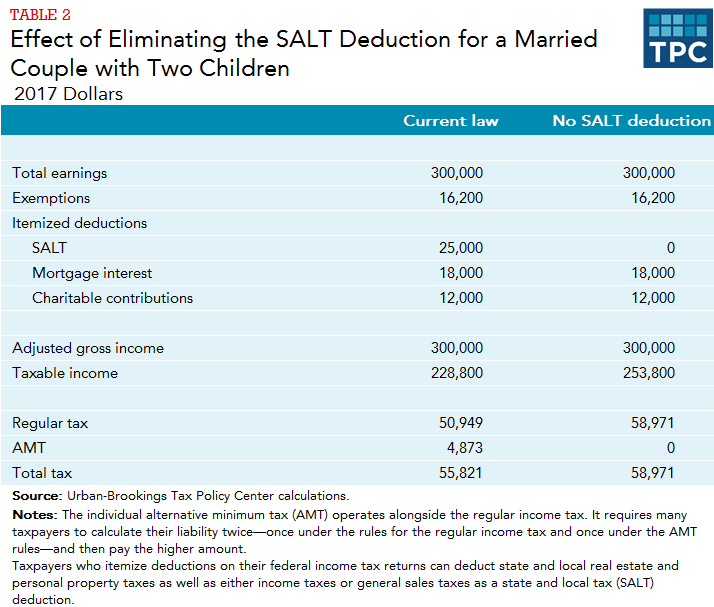

. For the 2019 tax year the marriage penalty associated with the 10000 limitation on state and local tax deductions which limits married couples filing jointly to 10000 of SALT deductions would be eliminated. The SALT tax deduction is a handout to the rich. Defenders of the.

It should be eliminated not expanded. Why does this matter. The Tax Policy Center estimates that 30 percent of taxpaying households about 39 million take the SALT deduction each year.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. For tax years 2020 and 2021 the 10000 limitation would be eliminated entirely for all taxpayers. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

State and local tax deductions were restricted or eliminated by the 2017 Tax Act. Taxpayers cant get out of them. The topic goes beyond simple politics.

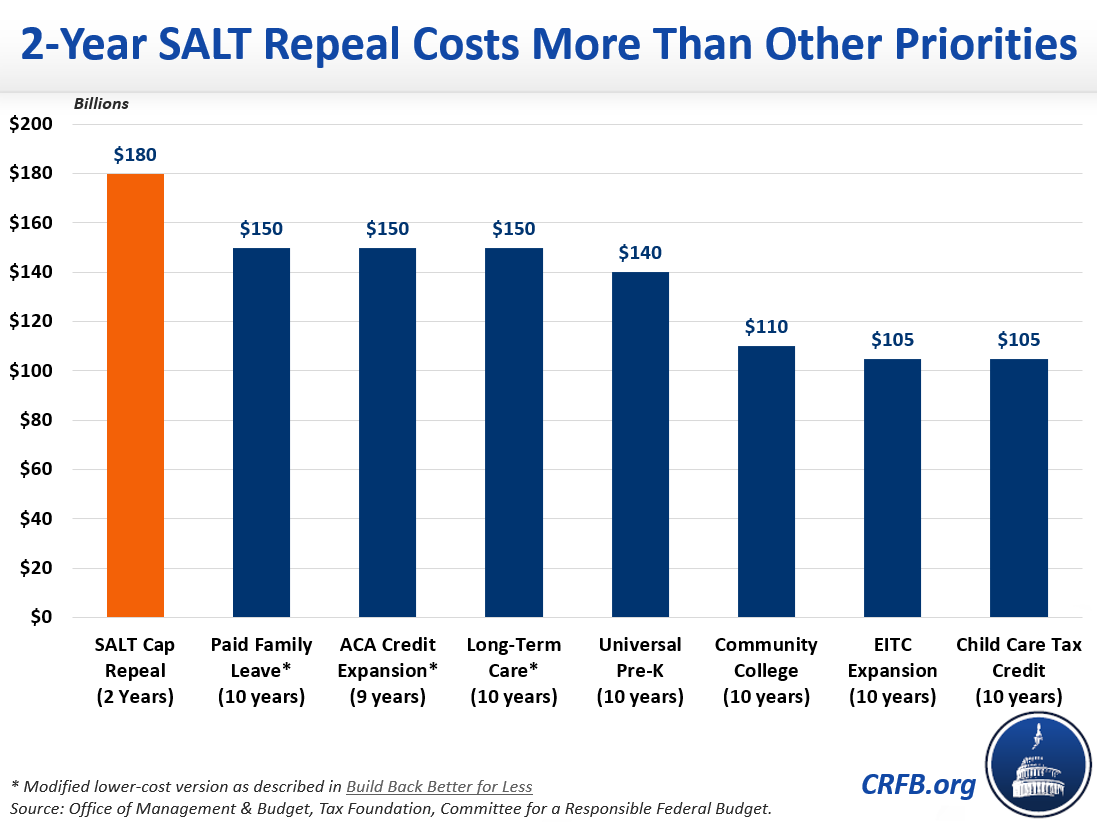

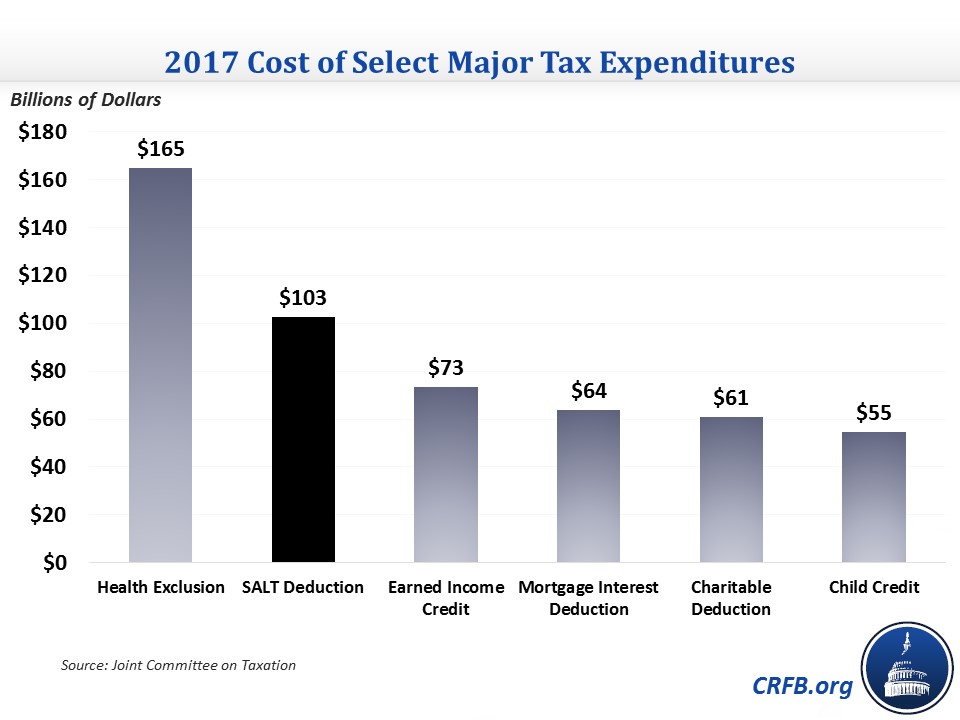

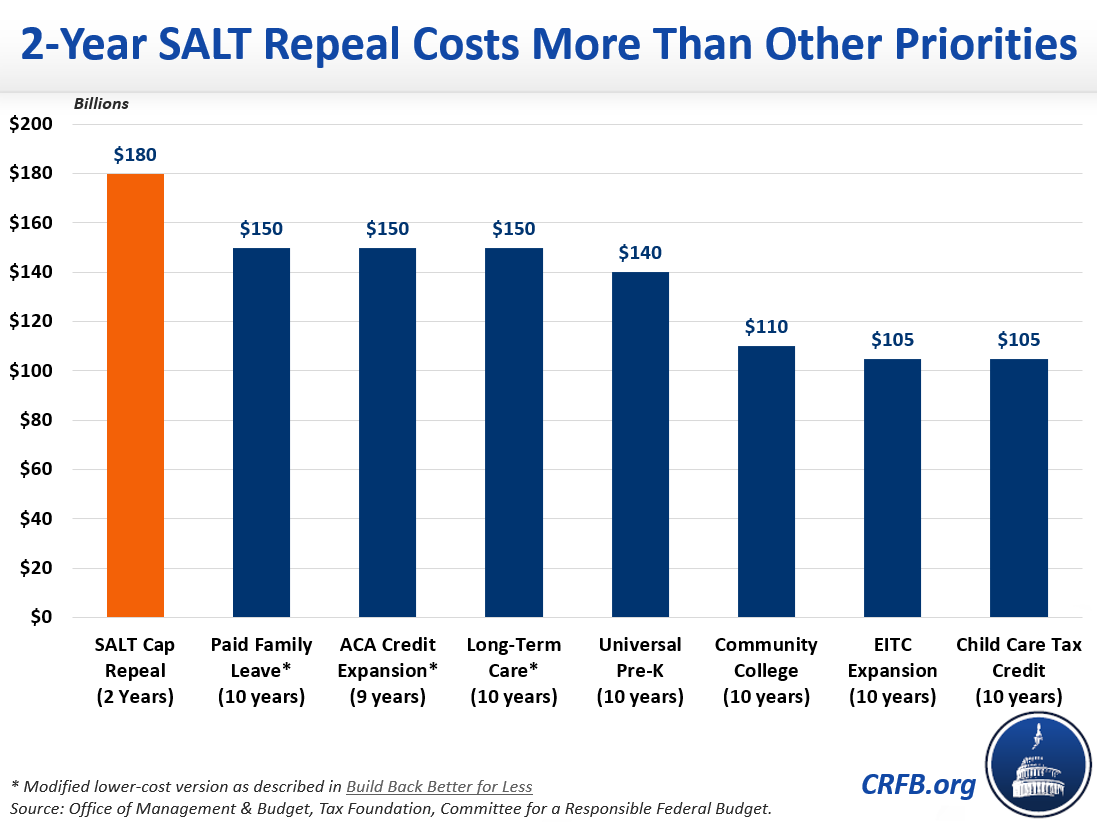

Many economists believe that a complete repeal of the cap on the SALT deduction would be costly to the federal government. A recent July 2021 estimate by the Tax Foundation put the loss to the Federal government at 380 billion. The IRS just issued Regulations preventing donations to.

If I become majority. The change may be significant for filers who itemize deductions in high-tax states and. Schumer said that Senate Democrats would make it a priority to permanently eliminate the SALT deduction cap if they are in the majority in 2021.

Defenders of the SALT deduction such as the National Governors Association point out that state and local income real estate and sales taxes are mandatory. Posted on November 9 2017 Updated on November 10 2017. Both the House and Senate are prepared to eliminate some or all of the SALT deduction to make up for revenue losses resulting from proposed cuts to the corporate and individual tax rates.

For advocates of the deduction eliminating it. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. Effectively the SALT cap.

The editorial apologizes for the Times having opposed the SALT cap in the past and says that in the interests of economic justice it wants the SALT deduction eliminated even though editorial board. The SALT deduction should be eliminated altogether along with the wide range of energy tax credits housing credits and place-based credits such as opportunity zones. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround.

New limits for SALT tax write off. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married. Enacted by the Tax.

The SALT deduction should be eliminated altogether along with the wide range of energy tax credits housing credits and place-based credits such as opportunity zones. The BBBA would raise the SALT deduction limitation from 10000 per year to 80000 per year from 2021 through 2030 lower it to 10000 in 2031 and then eliminate it. The Facts on the SALT Deduction.

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. The federal tax reform law passed on Dec. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package.

Yes eliminating the SALT deduction will be a tax primarily on the wealthy minority sorely needed to pay for programs to rebuild the country. This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017. Yes eliminating the SALT deduction will be a tax primarily on the wealthy minority sorely needed to pay for programs to rebuild the country.

If I become majority. If the law hadnt changed and no 10000 limit had been imposed the Bidens would have been able to deduct the entire 361966 they paid in state and local taxes in 2018. The House Republican tax plan would eliminate a federal tax deduction for.

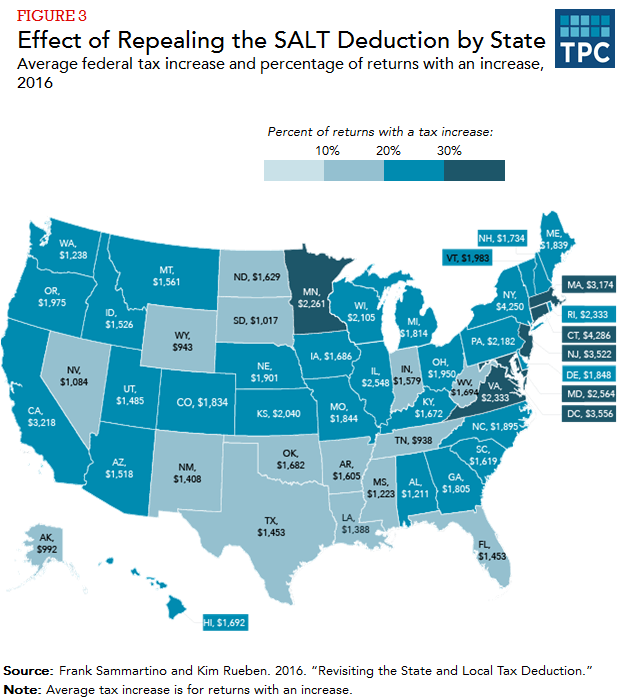

The Tax Policy Center made its projection in 2016 predicting a cost of 7382 billion in lost revenues to Treasury if Salt was eliminated for the five years beginning in 2021. I want to tell you this.

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

State And Local Tax Salt Deduction Salt Deduction Taxedu

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

The Salt Cap Overview And Analysis Everycrsreport Com

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center